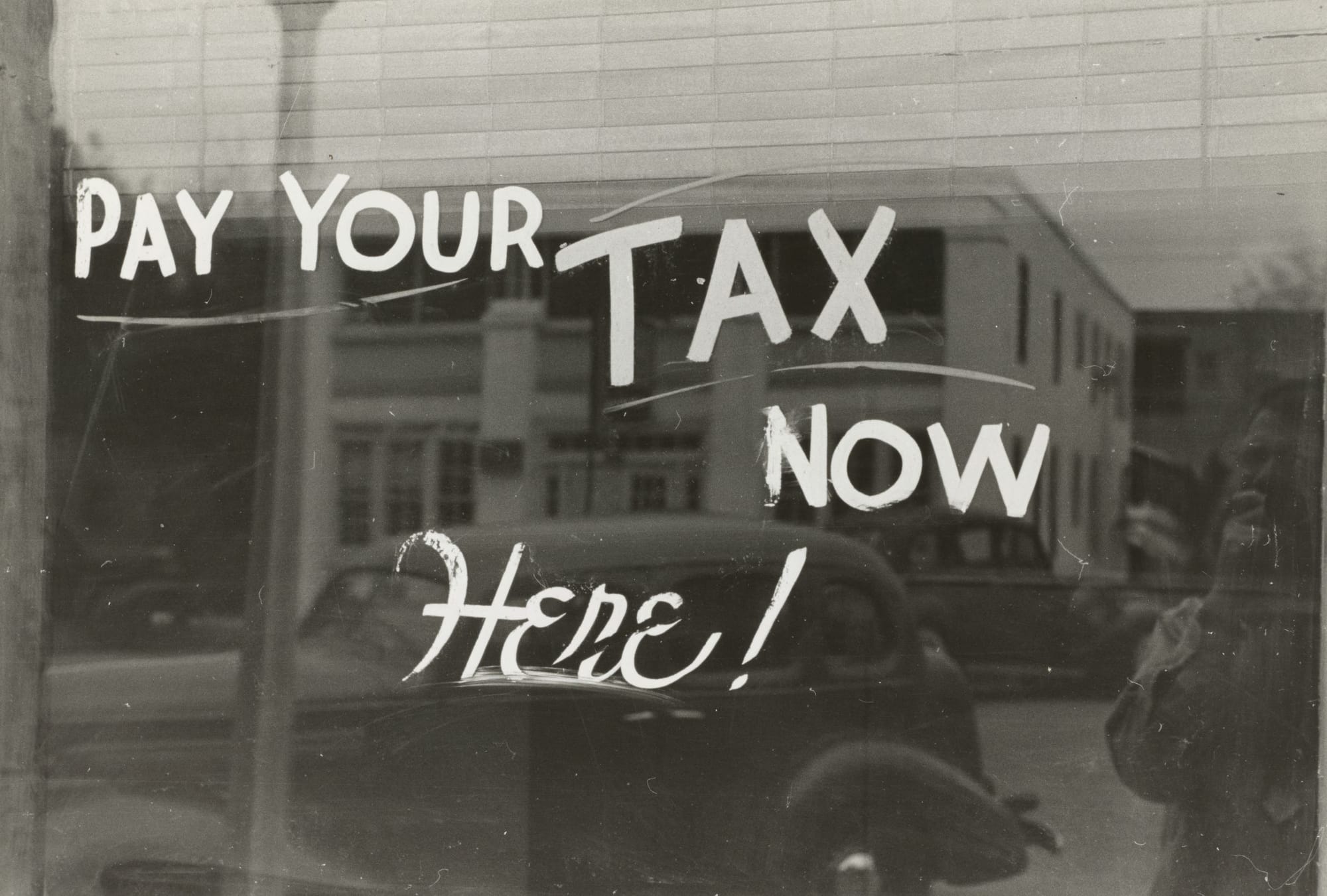

Learn whether silent auction items are tax deductible for the winners. CharityAuctionsToday can help you understand the ins and outs of auction tax deductions.

Silent auctions are a popular way to raise funds for charities. They involve bidding on items, often donated, in a quiet manner, either in writing or on mobile devices.

But have you ever wondered about the tax implications of these items? Specifically, are silent auction items tax deductible?

This question is not as straightforward as it may seem. The answer depends on various factors, including your role in the auction.

Understand the Tax Rules — Then Run with Confidence

You’ve learned how deductions work for donors and winners. Now take the next step: launch your auction on a platform that supports transparent pricing, donor receipts, and compliance.

Launch Your Tax-Smart AuctionIn this article, we will delve into the complexities of silent auction tax deductions. We aim to provide clear, accurate, and helpful information on this topic.

Whether you're a donor, a winner, or a nonprofit organization, this guide will help you navigate the tax landscape of silent auctions.

So, let's get started and unravel the mystery of silent auction tax deductions.

Understanding Silent Auctions and Tax Deductions

Silent auctions are fundraising events where items are bid on in writing. The highest bidder wins the item.

These items can be anything from artwork to vacation packages. They are often donated by individuals or businesses to support the cause.

But what about the tax implications of these items? Can they be considered as tax write-offs?

The answer is, it depends. The tax deductibility of silent auction items is governed by specific IRS rules. Here are some key points to consider:

- The tax implications differ for donors and winners.

- The value of the item plays a crucial role in determining tax deductions.

- Proper documentation is essential for claiming tax deductions.

What Constitutes a Tax Deductible Contribution?

A tax-deductible contribution is a donation that can be subtracted from your taxable income. This can reduce your tax liability.

However, not all contributions to charity are tax-deductible. The IRS has specific guidelines on what qualifies as a deductible contribution.

In the context of silent auctions, both the donation of items and the purchase of items can potentially qualify as tax-deductible contributions.

The IRS Criteria for Deductible Contributions

The IRS has set criteria for contributions to qualify as tax deductions. First, the contribution must be made to a qualified organization.

Second, the donor must be able to itemize deductions on their tax return.

Lastly, the donor must meet record-keeping requirements. This includes obtaining a written acknowledgment from the charity for any contribution of $250 or more.

For Donors: Tax Deductions on Donated Silent Auction Items

If you're donating an item to a silent auction, you may be able to claim a tax deduction. The deduction is generally equal to the amount you paid for the item.

However, there are some exceptions. For instance, if you created the item yourself, the deduction is limited to the cost of materials used.

Here are some key points for donors:

- The item must be donated to a qualified organization.

- The deduction is limited to the item's original cost.

- Proper documentation is required to claim the deduction.

Determining the Fair Market Value (FMV)

The FMV is the price that the item would sell for on the open market. It's not always easy to determine, especially for unique items.

In such cases, a professional appraisal may be needed. The IRS provides guidelines on how to determine the FMV in its Publication 561.

Remember, overvaluing items for tax deductions can lead to penalties.

Documentation and Record-Keeping for Donors

Keeping accurate records is crucial for claiming tax deductions. For each donated item, you should have a receipt from the charity, and from when you purchased the item.

The receipt should include details of the donation, such as the date and description of the item.

For donations valued at over $500, you'll need to fill out Form 8283 and attach it to your tax return.

For Winners: Are Your Auction Items Tax Deductible?

If you're the winning bidder at a silent auction, you might wonder if your purchase is tax-deductible. The answer is not straightforward.

In general, if you pay more than the fair market value (FMV) for an item, the excess amount can be considered a charitable donation. However, this only applies if the item was bought from a qualified organization.

It's important to note that you must itemize your deductions on your tax return to claim this benefit.

When Bidding Exceeds Fair Market Value

When your bid exceeds the FMV of an item, the excess amount is considered a charitable contribution. This is because you've essentially made a donation to the charity.

However, you must have a written acknowledgment from the charity that states the FMV of the item. The acknowledgment should also state that the excess amount was a donation.

Remember, it's crucial to keep this acknowledgment as proof of your donation when claiming a tax deduction.

Limitations and Considerations for Silent Auction Tax Deductions

While silent auction tax deductions can be beneficial, there are limitations. The IRS has set thresholds for charitable deductions.

For instance, you can only deduct donations up to 60% of your adjusted gross income (AGI). If your donations exceed this limit, you may carry over the excess to the next tax year.

Understanding Quid Pro Quo Contributions

In the context of silent auctions, a quid pro quo contribution occurs when you receive goods or services in exchange for your donation. The IRS requires that only the amount that exceeds the fair market value of the benefit received can be deducted.

For example, if you bid $500 on a silent auction item with a FMV of $300, you can only deduct $200.

This is why it's crucial to understand the FMV of the items you're bidding on. It helps you determine the potential tax deduction you can claim.

The Impact of Tax Law Changes on Deductions

Tax laws are subject to change, and these changes can impact your ability to claim silent auction tax deductions. For instance, the Tax Cuts and Jobs Act of 2017 increased the limit for cash contributions from 50% to 60% of AGI.

However, it also doubled the standard deduction, making it less beneficial for some people to itemize deductions.

Staying updated on these changes is crucial. It ensures you're maximizing your tax benefits while staying compliant with the law.

Conclusion: Maximizing Your Tax Benefits and Staying Compliant

Participating in silent auctions can be a rewarding experience. Not only do you get the chance to support a good cause, but you may also benefit from tax deductions.

However, it's crucial to understand the IRS rules and regulations surrounding these deductions. Proper documentation, accurate valuation of items, and understanding the concept of quid pro quo contributions are all key to maximizing your tax benefits.

Remember, when in doubt, consult with a tax professional. They can provide guidance tailored to your specific situation, ensuring you stay compliant while reaping the benefits of your charitable contributions.

Frequently Asked Questions

Are items I purchase at a silent auction tax-deductible?

Generally, only the portion you pay above the item’s fair market value (FMV) may be considered a charitable contribution. If you pay at or below FMV, there’s typically no deductible amount. This is general information, not tax advice.

How is fair market value (FMV) determined for auction items?

FMV is a reasonable estimate of what a willing buyer would pay in an open market. The nonprofit should provide a good-faith FMV for each lot (e.g., retail price, comparable sales, or typical rates). Keep that FMV with your receipt for your records.

What documentation do I need if I pay above FMV?

You should receive a written acknowledgment that shows the amount you paid and the FMV of the item (the difference is the potential deductible portion). Keep this with your tax records.

If I donate an item for the auction, can I deduct its value?

Possibly, but rules vary. For many donated goods, the allowable deduction may be limited to your cost basis rather than retail value—especially when the charity sells the item rather than uses it in its mission. Because this can be fact-specific (holding period, type of property, “related use”), ask a qualified tax professional.

Are donated services or my volunteer time deductible?

Your time or professional services aren’t deductible as a charitable contribution. However, reasonable out-of-pocket expenses you pay while volunteering (e.g., materials, mileage at the charitable rate) may be, if no significant benefit is received.

How do tax rules treat donated gift cards or certificates?

- Individual buys a card and donates it: Often treated similarly to a cash-equivalent gift up to the amount paid; keep your purchase receipt and the charity’s acknowledgment.

- Business issues its own certificate: Typically not deductible as a charitable gift at face value; the business may deduct costs when the certificate is redeemed, subject to its own tax rules. Businesses should consult their tax advisor.

If I’m the artist/maker, can I deduct the full value of my donated piece?

Typically no. Creators who donate their own work are often limited to deducting the cost of materials, not the fair market value of the finished work. Ask a tax professional about your specific situation.

Can a business deduct the retail value of inventory donated to an auction?

Usually no. Donations of inventory are generally limited to the business’s cost (with some special enhanced deductions in narrow cases). Businesses should confirm treatment with their CPA.

Is donating a weekend at my vacation home deductible to me as the owner?

Offering the use of property (e.g., lodging) is generally not a deductible charitable gift for the owner. You may be able to deduct certain out-of-pocket costs you pay for the charity, but not the rental value of the stay.

Are gala tickets or dinner packages deductible if they include benefits?

Your potential deduction is the ticket price minus the FMV of benefits received (meal, entertainment, swag, etc.). The acknowledgment should list the FMV of those benefits.

When are special receipts or forms required for auction-related gifts?

- $250 or more (cash or noncash): Donors generally need a contemporaneous written acknowledgment from the charity.

- Noncash over certain amounts: Additional donor forms and, at higher levels, a qualified appraisal may be required. Ask your tax advisor which thresholds apply to your gift.

Will the charity put a dollar value on my donated item receipt?

Often, charities provide a description of the donated property without assigning a value. Donors are typically responsible for determining and substantiating value on their own returns.

If I pay shipping or handling on an item I won, is that deductible?

No. Shipping or sales tax related to your purchase is generally not a charitable contribution. Only the amount paid above FMV for the item itself may be considered.

How is FMV estimated for experiences (tours, dinners, lessons)?

FMV is typically the usual price a member of the public would pay for the same or very similar experience. If there’s no exact match, the charity should make a reasonable estimate (e.g., menu pricing, hourly rates, comparable packages).

Our company donated to the auction—charitable gift or marketing expense?

If the business receives advertising/visibility benefits, some or all of the cost may be treated as a business expense rather than a charitable contribution. Businesses should consult their CPA for the appropriate classification.

Do state or local rules affect deductibility for auction events?

They can. Sales/use tax, raffle/gaming rules, and documentation requirements vary. Always follow local laws and the charity’s policies, and talk with a qualified advisor about your situation.

What records should I keep for auction-related tax purposes?

- Charity acknowledgment letters and any FMV statements.

- Proof of payment (credit card receipt, bank record).

- For donated property: purchase receipts, descriptions, photos, and any appraisals if required.

Do these rules apply outside the U.S.?

Tax treatment differs by country. If you live or file taxes outside the U.S., consult local guidance or a cross-border tax advisor.

Quick example: How do I know my deductible amount as a winning bidder?

If you paid $300 for an item with an FMV of $220, the potential charitable portion is $80 (subject to the usual rules and your personal tax situation). Keep the acknowledgment that shows both numbers.

Is this tax advice?

No. This FAQ provides general information for educational purposes. Tax outcomes depend on your facts and jurisdiction—please consult a qualified tax professional.

💡 Try this in ChatGPT

- Summarize the article "Are Silent Auction Items Tax Deductible?" from https://www.charityauctionstoday.com/p/are-silent-auction-items-tax-deductible/ in 3 bullet points for a board update.

- Turn the article "Are Silent Auction Items Tax Deductible?" (https://www.charityauctionstoday.com/p/are-silent-auction-items-tax-deductible/) into a 60-second talking script with one example and one CTA.

- Extract 5 SEO keywords and 3 internal link ideas from "Are Silent Auction Items Tax Deductible?": https://www.charityauctionstoday.com/p/are-silent-auction-items-tax-deductible/.

- Create 3 tweet ideas and a LinkedIn post that expand on this FAQ topic using the article at https://www.charityauctionstoday.com/p/are-silent-auction-items-tax-deductible/.

Tip: Paste the whole prompt (with the URL) so the AI can fetch context.

Share this article

Tom Kelly, TEDx speaker and CEO of CharityAuctions.com, helps nonprofits raise millions through auctions and AI. He hosts The Million Dollar Nonprofit podcast and inspires leaders to live their legacy, not just leave it.

Table of contents

Create Your Auction

Raise 40% more with smart bidding tools